Weekly Market Report

For Week Ending June 1, 2024

For Week Ending June 1, 2024

The average American household spent 24.2% of their income on mortgage payments in the first three months of the year, according to the National Association of REALTORS®, down from 26.1% the previous quarter. Assuming a 20% down payment, the typical monthly mortgage payment on an existing single-family home was $2,037 in the first quarter, an increase of 9.3%, or $173 per month, compared to the same period a year ago.

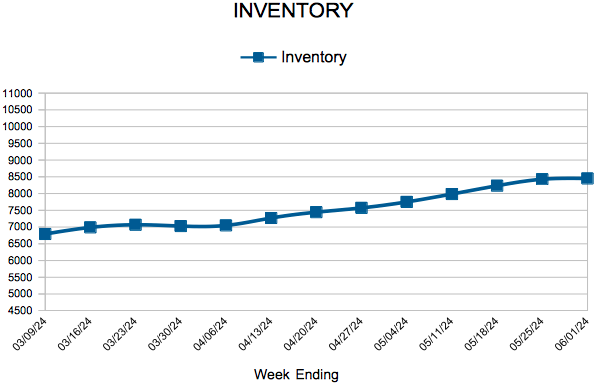

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 1:

- New Listings decreased 3.8% to 1,463

- Pending Sales decreased 5.0% to 960

- Inventory increased 14.0% to 8,450

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 25, 2024

For Week Ending May 25, 2024

Prospective homebuyers received good news recently in the form of declining mortgage rates, which fell for the third consecutive week, offering consumers some relief amid persistent affordability challenges. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.94% the week ending May 23, down from 7.02% the week before, marking the first time since early April that rates have fallen below 7%.

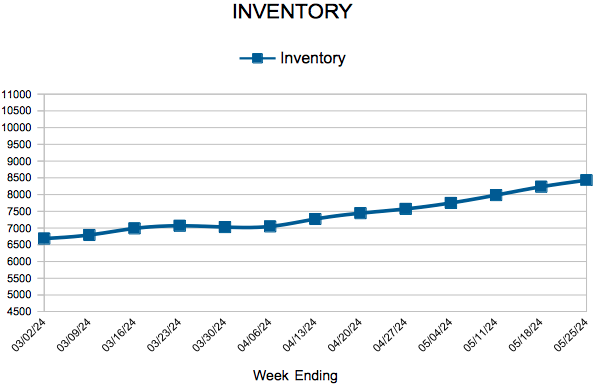

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 25:

- New Listings decreased 9.4% to 1,288

- Pending Sales decreased 6.6% to 1,127

- Inventory increased 14.9% to 8,428

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 18, 2024

For Week Ending May 18, 2024

According to the 2021 American Housing Survey, approximately 10.2 million households bought and moved to a new home in the two years preceding the date the survey was conducted. Of those, 40% of buyers purchased their first home, and 7% of buyers purchased a newly built home. First-time buyers had a median age of 33 years and a median income of $90,000, while new-home buyers had a median age of 45 years and a median income of $112,100. The median age of all homebuyers was 41 years, with a median income of $97,700.

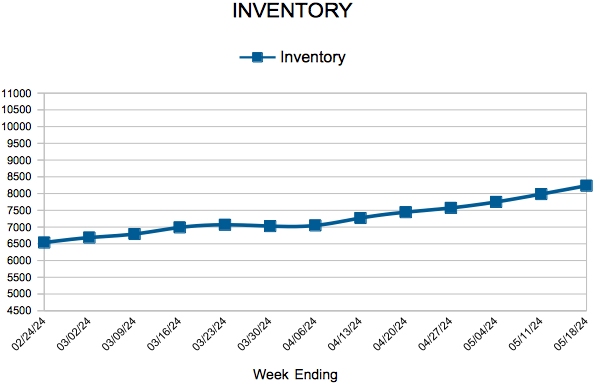

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 18:

- New Listings decreased 2.7% to 1,646

- Pending Sales decreased 4.9% to 1,028

- Inventory increased 16.9% to 8,234

FOR THE MONTH OF APRIL:

- Median Sales Price increased 4.1% to $385,000

- Days on Market remained flat at 46

- Percent of Original List Price Received decreased 0.2% to 99.9%

- Months Supply of Homes For Sale increased 23.5% to 2.1

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 13

- Next Page »